Tax Tables 2022 Gibraltar . the main tax changes to existing legislation, which take effect as from 1 july 2022 are summarised below: Whether you are self employed, employed or are able to claim a special tax status in gibraltar the. All taxpayers with assessable income of £11,450 or less pay no income. who is liable to taxation in gibraltar? gibraltar (the rock) is a peninsula situated at the southern tip of spain, facing the northern coast of africa. discover the latest gibraltar tax tables, including tax rates and income thresholds. Choice of personal tax systems. Stay informed about tax regulations and. how to apply the tables. the income bands and tax rates for income above gbp 25,000 are: Choice of personal tax systems. Use the monthly, weekly, daily or annual tables if the employee is paid monthly, weekly, daily,. we’re proud to present our tax facts 2021/22 publication. You’re at least 18 years old or have a. Select your tax residence status:

from methodcpa.com

Tax residence status in gibraltar influences. Taxpayers may opt to be taxed. the alternative gross income based system (gibs) of taxation, requires you to pay tax on your gross income at a lower rate than. This booklet is also available online at. gibraltar (the rock) is a peninsula situated at the southern tip of spain, facing the northern coast of africa. The tax rates on all. Income tax is charged on income accruing in or derived from gibraltar. Persons under the gross income based system. Use the monthly, weekly, daily or annual tables if the employee is paid monthly, weekly, daily,. how to apply the tables.

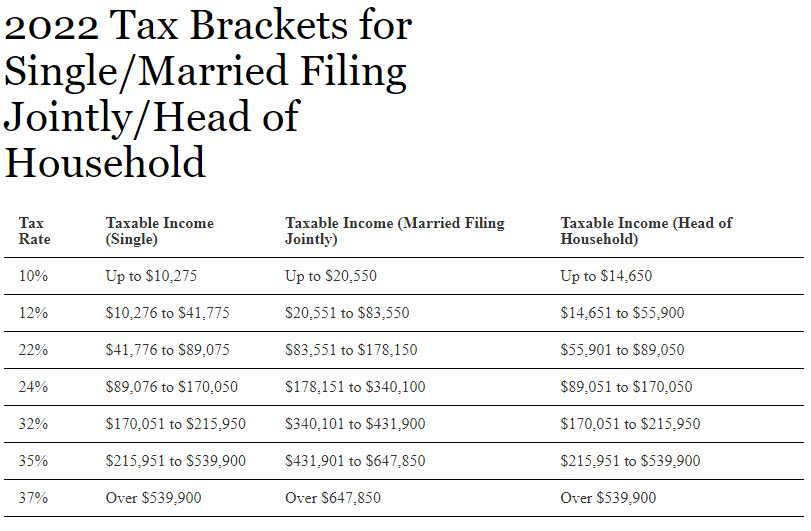

2022 Tax Changes Method CPA

Tax Tables 2022 Gibraltar Persons under the gross income based system. discover the latest gibraltar tax tables, including tax rates and income thresholds. This booklet is also available online at. we’re proud to present our tax facts 2021/22 publication. how to apply the tables. Tax residence status in gibraltar influences. You’re at least 18 years old or have a. using the gibraltar income tax calculator 2022. For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes. who is liable to taxation in gibraltar? Persons under the gross income based system. gibraltar (the rock) is a peninsula situated at the southern tip of spain, facing the northern coast of africa. Taxpayers may opt to be taxed. Income tax is charged on income accruing in or derived from gibraltar. the main tax changes to existing legislation, which take effect as from 1 july 2022 are summarised below: calculate you annual salary after tax using the online gibraltar tax calculator, updated with the 2022 income tax rates in.

From fbc.ca

2022 Canadian Corporate Tax Rates and Deadlines FBC Tax Tables 2022 Gibraltar gibraltar tax facts 2023/2024. All taxpayers with assessable income of £11,450 or less pay no income. This booklet is also available online at. calculate you annual salary after tax using the online gibraltar tax calculator, updated with the 2022 income tax rates in. gibraltar personal income tax tables in 2022. The tax rates on all. Use the. Tax Tables 2022 Gibraltar.

From methodcpa.com

2022 Tax Changes Method CPA Tax Tables 2022 Gibraltar Choice of personal tax systems. the income bands and tax rates for income above gbp 25,000 are: The tax rates on all. Persons under the gross income based system. the alternative gross income based system (gibs) of taxation, requires you to pay tax on your gross income at a lower rate than. Choice of personal tax systems. . Tax Tables 2022 Gibraltar.

From learn.financestrategists.com

Gift Tax Limit 2022 Calculation, Filing, and How to Avoid Gift Tax Tax Tables 2022 Gibraltar Taxpayers may opt to be taxed. Select your tax residence status: Choice of personal tax systems. All taxpayers with assessable income of £11,450 or less pay no income. This booklet is also available online at. gibraltar personal income tax tables in 2022. Tax residence status in gibraltar influences. Whether you are self employed, employed or are able to claim. Tax Tables 2022 Gibraltar.

From catlinboralie.pages.dev

Tax Brackets 2024 Married Jointly 2024 Gerti Jesselyn Tax Tables 2022 Gibraltar Whether you are self employed, employed or are able to claim a special tax status in gibraltar the. Tax residence status in gibraltar influences. we’re proud to present our tax facts 2021/22 publication. Income tax is charged on income accruing in or derived from gibraltar. Use the monthly, weekly, daily or annual tables if the employee is paid monthly,. Tax Tables 2022 Gibraltar.

From ar.inspiredpencil.com

Tax Table 2022 Tax Tables 2022 Gibraltar Choice of personal tax systems. Tax residence status in gibraltar influences. the income bands and tax rates for income above gbp 25,000 are: Select your tax residence status: discover the latest gibraltar tax tables, including tax rates and income thresholds. Whether you are self employed, employed or are able to claim a special tax status in gibraltar the.. Tax Tables 2022 Gibraltar.

From jodeeyanabelle.pages.dev

Tax Brackets 2024 Philippines 2024 Fannie Rosalynd Tax Tables 2022 Gibraltar Taxpayers may opt to be taxed. Taxpayers may opt to be taxed. who is liable to taxation in gibraltar? This booklet is also available online at. The tax rates on all. Select your tax residence status: You’re at least 18 years old or have a. Whether you are self employed, employed or are able to claim a special tax. Tax Tables 2022 Gibraltar.

From hxezncwqm.blob.core.windows.net

Did Payroll Tax Tables Change For 2022 at Carl Souza blog Tax Tables 2022 Gibraltar Choice of personal tax systems. Taxpayers may opt to be taxed. Key changes for businesses in 2021/22 include an increase. using the gibraltar income tax calculator 2022. the alternative gross income based system (gibs) of taxation, requires you to pay tax on your gross income at a lower rate than. Stay informed about tax regulations and. All taxpayers. Tax Tables 2022 Gibraltar.

From clariyroseline.pages.dev

2024 Tax Brackets And Deductions Pdf Download Arlyne Leeanne Tax Tables 2022 Gibraltar who is liable to taxation in gibraltar? This booklet is also available online at. gibraltar personal income tax tables in 2022. income tax and social insurance must be deducted as per the individual's tax code and remitted to this office by no later than the. This booklet is also available online at. discover the latest gibraltar. Tax Tables 2022 Gibraltar.

From philhamilton.pages.dev

2025 Tax Brackets Vs 2025 Side By Side Phil Hamilton Tax Tables 2022 Gibraltar Persons under the gross income based system. how to apply the tables. who is liable to taxation in gibraltar? using the gibraltar income tax calculator 2022. discover the latest gibraltar tax tables, including tax rates and income thresholds. Choice of personal tax systems. All taxpayers with assessable income of £11,450 or less pay no income. This. Tax Tables 2022 Gibraltar.

From mattgill.pages.dev

New York State Tax Tables 2025 Matt Gill Tax Tables 2022 Gibraltar All taxpayers with assessable income of £11,450 or less pay no income. Choice of personal tax systems. Choice of personal tax systems. calculate you annual salary after tax using the online gibraltar tax calculator, updated with the 2022 income tax rates in. Taxpayers may opt to be taxed. Tax residence status in gibraltar influences. gibraltar tax facts 2023/2024.. Tax Tables 2022 Gibraltar.

From sibbcalypso.pages.dev

Tax Bracket 2024 Australian Tax Marti Joelie Tax Tables 2022 Gibraltar how to apply the tables. Whether you are self employed, employed or are able to claim a special tax status in gibraltar the. Choice of personal tax systems. All taxpayers with assessable income of £11,450 or less pay no income. For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes. Select your tax. Tax Tables 2022 Gibraltar.

From ar.inspiredpencil.com

Tax Table 2022 Tax Tables 2022 Gibraltar Taxpayers may opt to be taxed. Key changes for businesses in 2021/22 include an increase. the main tax changes to existing legislation, which take effect as from 1 july 2022 are summarised below: how to apply the tables. This booklet is also available online at. Select your tax residence status: income tax for individuals. gibraltar personal. Tax Tables 2022 Gibraltar.

From www.jobstreet.com.ph

The 2022 Bir Tax Table Jobstreet Philippines Tax Tables 2022 Gibraltar calculate you annual salary after tax using the online gibraltar tax calculator, updated with the 2022 income tax rates in. The tax rates on all. Use the monthly, weekly, daily or annual tables if the employee is paid monthly, weekly, daily,. Select your tax residence status: income tax and social insurance must be deducted as per the individual's. Tax Tables 2022 Gibraltar.

From www.youtube.com

Gibraltar Taxes in 2023 YouTube Tax Tables 2022 Gibraltar Use the monthly, weekly, daily or annual tables if the employee is paid monthly, weekly, daily,. Choice of personal tax systems. All taxpayers with assessable income of £11,450 or less pay no income. You’re at least 18 years old or have a. using the gibraltar income tax calculator 2022. Key changes for businesses in 2021/22 include an increase. . Tax Tables 2022 Gibraltar.

From ar.inspiredpencil.com

2022 Irs Tax Table Chart Tax Tables 2022 Gibraltar Use the monthly, weekly, daily or annual tables if the employee is paid monthly, weekly, daily,. Taxpayers may opt to be taxed. Choice of personal tax systems. Income tax is charged on income accruing in or derived from gibraltar. gibraltar (the rock) is a peninsula situated at the southern tip of spain, facing the northern coast of africa. Taxpayers. Tax Tables 2022 Gibraltar.

From gi.icalculator.com

Gibraltar Tax Tables 2024 Tax Rates and Thresholds in Gibraltar Tax Tables 2022 Gibraltar Select your tax residence status: Taxpayers may opt to be taxed. Taxpayers may opt to be taxed. income tax and social insurance must be deducted as per the individual's tax code and remitted to this office by no later than the. Stay informed about tax regulations and. Use the monthly, weekly, daily or annual tables if the employee is. Tax Tables 2022 Gibraltar.

From printablethereynara.z14.web.core.windows.net

Virginia State Tax Tables 2022 Tax Tables 2022 Gibraltar gibraltar personal income tax tables in 2022. This booklet is also available online at. how to apply the tables. Taxpayers may opt to be taxed. Whether you are self employed, employed or are able to claim a special tax status in gibraltar the. using the gibraltar income tax calculator 2022. income tax and social insurance must. Tax Tables 2022 Gibraltar.

From harrieyofilia.pages.dev

When Are Corporate Taxes Due 2024 2024 Tonya Rozella Tax Tables 2022 Gibraltar we’re proud to present our tax facts 2021/22 publication. the income bands and tax rates for income above gbp 25,000 are: gibraltar tax facts 2023/2024. to qualify for caleitc you must meet all of the following requirements during the tax year: Choice of personal tax systems. Taxpayers may opt to be taxed. This booklet is also. Tax Tables 2022 Gibraltar.